Selling the business that you’ve worked tirelessly to build will most likely be a once in a lifetime event.

Our experienced team will draw reference from the many deals that we have completed to date and will be glad to put you in touch with business principals and colleagues who have been through the process of integrating with the wider Fairstone team.

To further simplify the process our team can introduce you to a panel of commercial law firms who will act independently on your behalf and who understand in detail our DBO structure and contracts. All of the law firms that we recommend will act for you on a fixed fee basis and there is a set cap on the legal fees that they will charge.

We also offer to:

They will create a bespoke package of training and support for advisers and staff whilst ensuring that you can achieve optimum capital value by accessing our catalyst services.

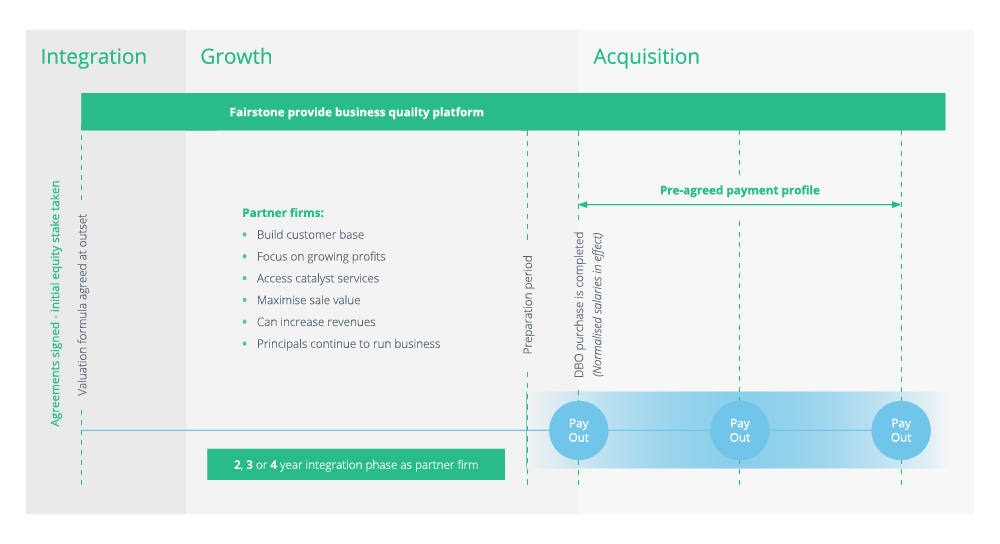

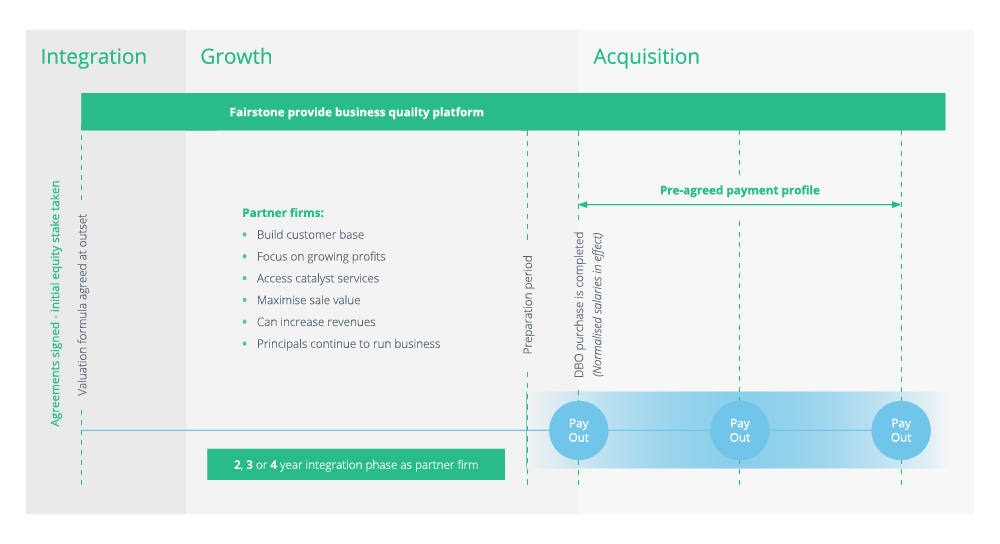

Business owners will have a high degree of flexibility over the timescales of the ultimate sale and while we maintain a minimum integration period of two years, this can be extended by firms that want to optimise their business growth and subsequent sale value.

As part of our DBO proposition all selling shareholders are encouraged to take on a more involved M&A role within the business once their acquisition is complete, opening up a further opportunity to create significant value and securing their long-term future with Fairstone.

Utilising Fairstone’s capital, alongside their first-hand experience of the proposition and local market knowledge, they continue to grow their hubs, identifying like-minded firms to bolt on to their businesses via our Satellite DBO model, mentoring them throughout the process.